Budget Briefing 2022

Budget aimed at addressing rising inflation

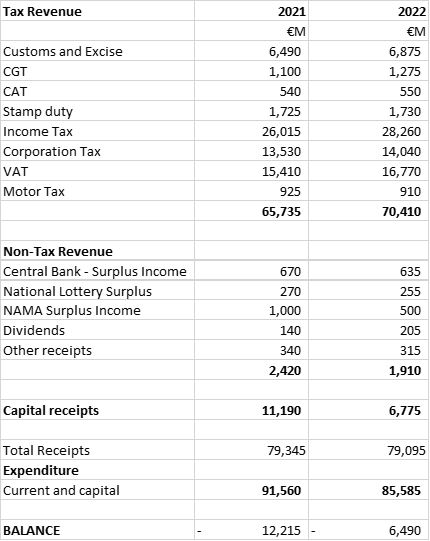

Against a backdrop of €240 billion of borrowings and with forecasted additional tax receipts for 2021 of €5.635 billion, the Coalition Government today, 12 October 2021, announced a Budget with the following limited tax changes:

Business Taxes/ Incentives

Corporation Tax

The Irish corporation tax rate of 12.5% has been a core principle of the Irish taxation system for 20 years. However, last week the Government advised that it has signed up to a proposal set out by the Organisation for Economic Cooperation and Development (OECD) to reform global tax rules. The proposal agrees to have a global corporation tax rate of 15% with effect from 2023. The rate of 15% will only apply to companies that have a global turnover in excess of €750 million per annum. Therefore, the majority of Irish owned businesses will continue to pay corporation tax at 12.5%.

Employment Supports

The Employment Wage Subsidy Scheme (EWSS), introduced as a result of Covid-19 will be extended in a graduated form to 30 April 2022. The scheme will taper off but there will be no changes for October and November 2021. The reduced rate of Employers PRSI will no longer apply from 1 March 2022. The scheme is closed to new employers from 1 January 2022.

Aviation Sector

Currently, where an aircraft is operated by an airline which has its place of management in the state, the air crews are subject to income tax in Ireland even where their employment is exercised abroad. This will be amended in the Finance Bill to exclude certain non-resident flight crew.

Employment Investment Incentive Scheme (EIIS)

The EIIS is being extended and expanded for a further 3 years to the end of 2024. The rules around the ‘’capital redemption window’’ are being relaxed and the rule that 30% of the investment must be spent before relief can be claimed is being removed.

Relief for Certain Start-Up Companies

The relief for certain start-up companies is being extended for a period of 5 years up until 31 December 2026. The relief will also be available for up to 5 years in place of the current 3 year limit.

Digital Gaming

The Minister has introduced a refundable corporation tax credit for expenditure incurred on a digital game. The relief will be available at a rate of 32% on eligible expenditure up to a maximum of €25m per project. This measure is subject to European State Aid approval.

VAT

The VAT rate reduction announced in Budget 2021 to 9% from 13.5% for the hospitality and tourism sector was due to expire on 31 December 2021. This has now been extended to 31 August 2022.

The farmer’s flat rate is being reduced from 5.6% to 5.5% from 1 January 2022.

Electric Cars/ VRT

No BIK applies on the provision of company electric cars to employees during the period to 31 December 2022 where the market value of the car is €50,000 or less. If the market value is over €50,000, then the BIK is calculated on the excess over €50,000. The exemption has been extended to 2025 with a tapering effect on the vehicle value. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, €20,000 for 2024 and €10,000 for 2025.

The €5,000 VRT relief for battery electric vehicles will be extended for a further 2 years to the end of 2023.

A new VRT table is being introduced from 1 January 2022 with increases of between 1% and 4% for bands 9-20.

Accelerated Capital Allowances

Energy efficient equipment directly operated by fossil fuels will no longer qualify for relief.

The scheme for gas vehicles has been extended for 3 years and the scheme has been extended to include hydrogen powered vehicles and refuelling equipment.

Employer’s PRSI

From 1 January 2022 the weekly income threshold for the higher rate employer’s PRSI will increase from €398 to €410.

No Changes To:

- Stamp Duty

- Gift or Inheritance Tax rates or group threshold bands

- CGT rates

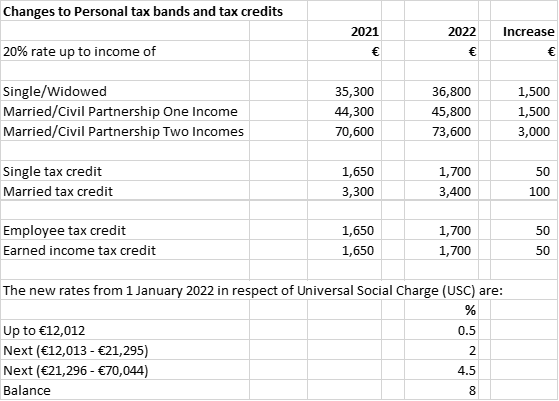

Income Tax

The Help To Buy Scheme

This scheme has been retained at its current rates to the end of 2022. A full review of the scheme will be carried out during 2022. This provides for a refund of Income Tax and DIRT of up to €30,000 on the purchase of a new house for first time buyers.

Pre-letting Expenses for Landlords

The relief for pre-letting expenses of up to €5,000 for landlords will be extended for a further 3 years up to 31 December 2024.

Remote Working

Individuals working from home will benefit from an income tax deduction amounting to 30% of the cost of vouched expenses on heating, electricity and broadband bills for days worked at home. This will be formalised in the Finance Bill.

Income Tax Exemption on Sale of Electricity back to Grid

A modest tax disregard has been introduced in respect of personal income up to €200 received by households who sell surplus electricity that they generate back to the grid.

Other Revenue Measures

Zoned Land Tax

Owners of zoned and serviced property which is zoned for residential or a mix of uses including residential that is not developed will be liable to a 3% tax on the market value. A self-assessed declaration will operate similar to Local Property Tax. There will be a lead in time of 2 years for land zoned before January 2022 and 3 years for land zoned after January 2022. It will replace the vacant site levy. Full details will be included in the Finance Bill. Dwelling houses and their gardens will be exempt.

Carbon Tax

The carbon tax per tonne of carbon dioxide emitted from the burning of fossil fuels will increase from €33.50 to €41 per tonne. This equates to about 2 to 2.5c per litre of petrol and diesel with effect from midnight tonight. Home heating is also set to increase by €19.40 for a 900 litre tank of oil from next May.

Carbon tax will continue to increase by €7.50 per tonne each year to 2030.

Farming

General Stock relief extended to 31 December 2024.

Young trained farmers stock relief and stamp duty relief has only been extended to 31 December 2022 due to European State Aid rules.

Bank Levy

Extended for another year – forecast to raise €87m in tax.

Excise Duties

Excise duties on cigarettes has increased by 50 cent.

There will be no increase to tax on alcoholic beer or wine, either on-sales or off-licences.

Minimum Wage

The minimum wage will increase by 30 cent from €10.20 to €10.50 per hour.

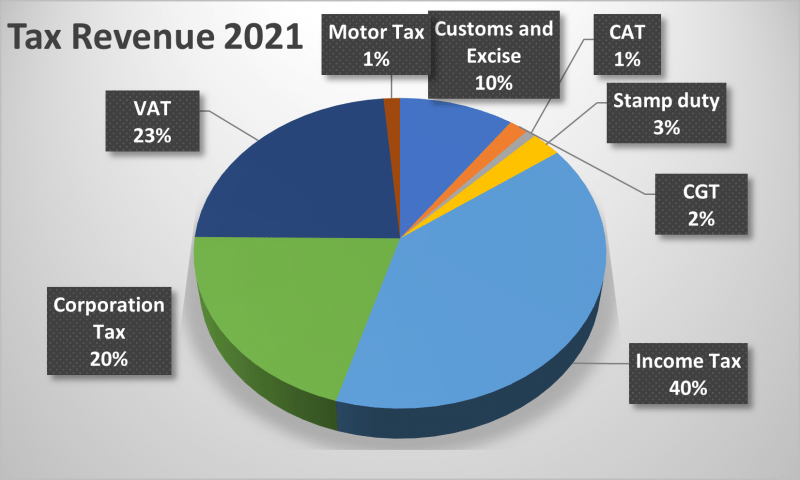

Forecasted Tax Revenues for 2021 will exceed budget by €5.635 Billion

The detail in the Budget and other amendments in tax legislation will be contained in the Finance Bill 2021 which should be published on 21 October 2021. However, please note some legislation may be passed tonight by Financial Resolutions.

This summary is intended as a general guide. No action should be taken without obtaining professional taxation advice.

If you have any queries, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700 or email your usual PMQ contact.

Purcell McQuillan Tax Partners Limited 12 October 2021.