Budget Briefing 2021

A Budget Like No Other

Overshadowed by Covid-19 and Brexit and with a backdrop of a Budget deficit of €21.5 billion for 2020 and a forecasted deficit of €20.5 billion for 2021, the Coalition Government today, 13 October 2020, announced the biggest ever Budget package of €17.75 billion. The key tax changes are as follows:

Business Incentives

Covid Restrictions Support Scheme

A new cash grant for accommodation, food and the arts, recreation and entertainment industries where access has been restricted due to Level 3 restrictions or higher, will apply from today until 31 March 2021. This new scheme will provide cash payments of 10% of turnover of up to €1 million per annum and 5% on the remaining annual turnover based on average weekly turnover for 2019. The weekly turnover must not exceed 20% of the corresponding 2019 turnover. The cash payment is capped at a maximum of €5,000 per week.

For example, a business which had an annual VAT exclusive turnover of €4 million in 2019 will be able to claim:

€

10% on €1M 100,000

5% on €3M 150,000

Total: 250,000

For each week of restrictions where the business remains closed at Level 3 or above, it will receive €4,808 (€250,000 /52).

Debt Warehousing – Self Employed Income Tax

Self-employed individuals who are affected by Covid can postpone payment of the balance of their 2019 income tax liability and their 2020 preliminary tax which is due by 10 December 2020. No interest will apply on the non-payment for 12 months and 3% interest will apply thereafter. The income tax return must still be filed by 10 December 2020. No surcharge to apply.

Employment Supports

The Employment Wage Subsidy Scheme (EWSS) which replaced the Temporary Wage Subsidy Scheme has been extended from 31 March 2021 to 31 December 2021. In order to qualify for the scheme, turnover or customer orders must be reduced by 30% compared to 2019 in the six month period from 1 July 2020 to 31 December 2020. The scheme provides for a payment of up to €203 per week for each employee whose salary is between €7,878 and €76,024. Employer PRSI is reduced to 0.5%. The conditions for the scheme are due to be reviewed next year and may be amended but there will be no “cliff edge” for businesses.

The July Stimulus package also introduced a €3,000 incentive for employers who take on new apprentices.

Commercial Rates

Commercial rates are waived for the last quarter of 2020.

VAT

The standard rate of VAT was reduced to 21% (from 23%) in the July Stimulus package for sixmonths ending 28 February 2021. This has not been extended in the Budget.

VAT rate reduction from 13.5% to 9% for the hospitality and tourism sector.This comes into effect on 1 November 2020 and will remain in place until 31 December 2021.

Farmer Flat Rate increased from 5.4% to 5.6% from 1 January 2021.

Corporation Tax

The Knowledge Development Box has been extended for a further 2 years up to the end of 2022.

All intangible assets acquired after today will be within the balancing charge rules. Previously, no balancing charge arose on the disposal of such assets where they were held for at least 5 years.

A new tax credit for digital gaming will be introduced from January 2022.

S.481 Film Regional Uplift will remain in place until 31 December 2023.

Accelerated Capital Allowances Schemes for energy efficient equipment has been extended for a further 3 years.

Further measures in line with the EU Anti-Tax Avoidance Directive (“ATAD”) will be introduced next year in respect of interest limitation and anti-reverse-hybrid rules. A technical amendment to the ATAD compliant Exit Tax rules introduced in Finance Act 2018 will also be introduced effective from tonight.

Stamp Duty

The Stamp Duty Residential Development Refund Scheme has been extended from 31 December 2021 to 31 December 2022. The completion period has also been increased from 2 years to 2.5 years. This means where a project commences by 31 December 2022 it will need to be completed within 2.5 years from that date.

The 1% consanguinity relief in relation to the transfer of agricultural land has been extended for 3 years to December 2023.

The 1% stamp duty rate for Farm Consolidation Relief has also been extended for 2 years until 31 December 2022.

Income Tax

The Help to Buy Scheme applies to the purchase/ build of new property for first time buyers between 19 July 2016 and 31 December 2021.Prior to the July 2020 Stimulus the maximum amount of the relief was the lesser of €20,000 or 5% of the purchase price.The July Stimulus amended the Help to Buy Scheme to increase the maximum amount of relief to the lesser of €30,000 or 10% of the purchase price.The increased maximum relief has been extended to 31 December 2021.

The Earned Income Credit will increase by €150 to €1,650 from 1 January 2021.

The Dependent Relative Tax Credit will be increased from €70 to €245 where you maintain a relative at your own expense.

To take account of the increase in the minimum wage, the USC second rate band of 2% has been increased from €20,484 to €20,687 and the Employer PRSI higher rate weekly threshold has been increased from €394 to €398.

No change to the Stay and Spend Tax Credit of a maximum €125 or 20% of expenditure spent between 1 October 2020 and 30 April 2021 on accommodation, food and non-alcoholic drinks introduced in the July Stimulus package.

Remote Working – where your employer does not pay a daily allowance for expenses incurred for working from home, a tax deduction may be claimed for expenses wholly, exclusively and necessarily incurred in the performance of the duties of employment.The tax deduction is calculated based on the number of days worked from home multiplied by the household expenses e.g. heating, ESB and broadband and multiplied by Revenue’s agreed rate of 10%.

Alternatively, an employer can pay an employee a daily allowance of €3.20 without a charge to BIK.

Other Revenue Measures

Excise duties on cigarettes to rise by up to 50 cents. A 20 pack of cigarettes will now cost €14.

Vehicle registration tax and motor tax to be reformed to incentivise low emission and electric vehicles. Motor tax to be aligned with emissions from 1 January 2021. The forecasted €7.50 increase in carbon tax will increase the cost of a litre of petrol by 2.16 cents while increasing a litre of diesel by 2.51 cents from tonight. Home heating oil will increase from May 2021. Carbon tax will continue to increase by €7.50 per tonne each year to 2030.

A €1,500 VRT rebate for hybrids and €2,500 for plug in hybrids will not be extended beyond 31 Dec 2021. To compensate the VRT rate on these vehicles will be reduced. Electric motorcycles are exempt from VRT until 31 December 2021.

An electric car can be made available to your employee for private use with no charge to BIK where the OMV of the car is €50,000 or less. The 2019 Finance Act extended the exemption for electric cars provided to employees before 31 December 2022.

No Changes To:

Corporate Tax Rate (Minister reconfirmed his commitment to the 12½% rate)

CGT (small amendment to entrepreneur relief in relation to holding of 5% ordinary shares for a continuous period of any 3 years but no change to limit of relief which remains at €1 million)

Gift or Inheritance Tax

Income Tax rates or bands

OECD Corporate Tax Proposals

The Department of Finance has forecast €12.5 billion from corporate tax in 2020 up from €10.9 million in 2019. The Minister for Finance has confirmed an updated corporate tax roadmap will be published shortly.

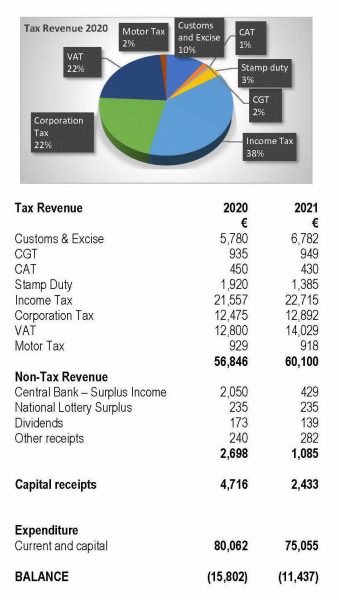

This is against the backdrop of the update published by the OECD on its proposed tax reform yesterday. Under these proposals, multinationals will have to pay tax where their products and services are sold and, secondly, a minimum global corporate tax rate is to be agreed between member countries. Agreement on the proposal to be extended to mid-2021. These changes, if agreed, could have long term implications for Ireland’s corporation tax which now accounts for 22% of the overall tax base as set out in the table below.

Tax Revenues

The detail in the Budget and other amendments in tax legislation will be contained in the Finance Bill 2020 which should be published on 22 October 2020. However please note some legislation will be passed tonight by Financial Resolutions.

Please note that this is a general summary and no action should be taken without taking detailed advice.

If you have any queries on the Budget, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700.

Purcell McQuillan Tax Partners Limited 13 October 2020.