Budget Briefing 2023

Budget 2023 – The Cost-of-Living Budget

The Coalition Government today, 27 September 2022, announced a Budget package of €11 billion which aims to alleviate the cost-of-living crisis and the threat to jobs from the surge in energy costs as well as managing the long-term challenges of housing, health, education, and climate.

Budget Package

The Budget will consist of extra spending of €6.9 billion and once-off measures of €4.1 billion. The core spending is broadly in line with the figures outlined in the Summer Economic Statement, while the surplus this year has enabled the introduction of the once-off measures. The packages announced today include the following:

Fuel:

- Energy rebates up to €600 split across three payments, with one payment before Christmas and two in early 2023.

- An extension for the current cuts on the excise and VAT on fuel to 28 February 2023.

- An expansion of the fuel allowance scheme to ensure more pensioners qualify for the support with a focus on those over 70.

- An extra €400 one-off payment on the fuel allowance coupled with a €200 lump sum for those in receipt of the living alone allowance.

Business’ Supports:

- Introduction of an energy scheme called Temporary Business Energy Support Scheme (TBESS) aimed at SMEs carrying on a Case I trade, to help with the spiralling cost of electricity and heating bills, by paying for 40% of the increase in gas and electricity that businesses are facing. TBESS will be capped at €10,000 per month per business.

- A second energy scheme aimed at larger energy intensive firms involved in the manufacturing and/or international traded services sectors.

Children:

- 25% reduction in childcare costs from 1 January 2023.

- The rollout of free schoolbooks for primary school children from September 2023 and a reduction in the pupil-teacher ratio that will see it go from 24:1 to 23:1.

- Double child benefit payment payable in November 2022.

- For third-level students, the cost of going to college is to be reduced by €1,000 in 2022 and a reduction of €500 in 2023 subject to an income cap of €100,000.

Other:

- An extension for the duration of 2023 on the price reduction on public transport fares.

- Tax credit to support renters of €500 per person in 2022 and subsequent years.

- Increase to social welfare payments and state pension of €12 per week.

- 430,000 more people will be eligible to receive a GP visit card.

- €500 disability support grant.

- €500 payment to all carers.

- The monthly Domiciliary Care Allowance is to increase by €20.50.

- Minimum wage has increased from €10.50 to €11.30 per hour.

- Once-off double weekly payment for pensioners, job seekers and carers in October 2022.

Changes to Tax

Corporation Tax

- Extension of the Knowledge Development Box for a further four years.

- Amendments to the payable element of the Research & Development tax credit to ensure it aligns with new international definitions.

- Extension of the film corporation tax credit from December 2024 to December 2028.

- The commencement of a review into several tax regimes including REITs, IREFs and section 110 regimes.

- Extension of bank levy for a further year.

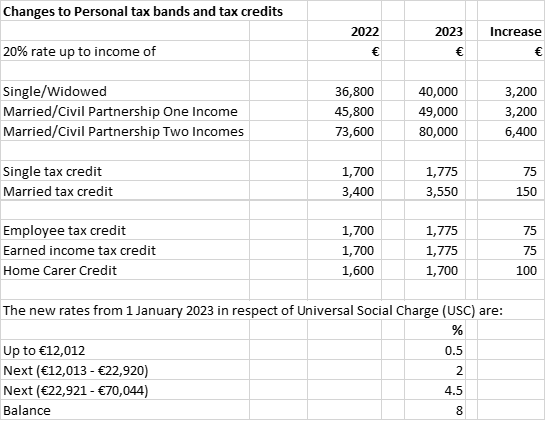

Income Tax

- Concession for the reduced rates of USC for those holding a medical card with earnings of less than €60,000 was extended for another year.

- The Small Benefit Exemption which allows an employer to provide limited non-cash benefits or rewards to their workers without the payment of income tax, PRSI and USC has been increased to €1,000 (previously €500) and the exemption will also permit two vouchers to be granted by an employer in a single year. This will be effective from 2022.

- Special Assignee Relief Programme (SARP) extended until 2025. The qualifying income has been increased to €100,000.

- Key Employee Engagement Programme (KEEP) extended until the end of 2025 and the commencement of the key 2019 provisions following European Commission approval.

- Enhanced pre-letting expenses regime for landlords with the doubling of the amount per premises to €10,000 and through reducing the period for which the premises must be vacant to six months.

VAT

- The VAT rate reduction announced in Budget 2021 to 9% from 13.5% for the hospitality and tourism sector will continue until February 2023.

- The introduction of 0% rate on newspapers as part of a wider media package.

- The VAT rate on defibrillators will be reduced to 0%.

- The VAT rate on hormone replacement and nicotine replacement therapies will be reduced to 0%.

Stamp Duty

The Residential Development Stamp Duty Refund Scheme is being extended to the end of 2025.

Farmers

The extension of five agricultural tax reliefs expiring this year:

- The Young Trained Farmer Stamp Duty Relief,

- The Farm Consolidation Stamp Duty Relief,

- The Farm Restructuring CGT relief,

- The Young Trained Farmer Stock Relief, and

- The Registered Farm Partnership Stock Relief.

The duration of these extensions is dependent on the outcome of negotiations at a European level.

The introduction of a time-limited scheme of accelerated capital allowances for farmers for the construction of modern slurry storage facilities.

Vacant Home Tax

Introduction of a Vacant Homes Tax which we assume targets holiday homes. The tax will be charged at a rate equal to three times the property’s existing basic LPT rate. The tax will apply to residential properties which are occupied for less than 30 days in a 12-month period.

Defective Concrete Products Levy

The introduction of a Defective Concrete Products Levy expected to raise €80 million annually to be applied from the 3 April 2023 at a rate of 10 per cent.

Excise Duties

Excise duties on cigarettes increased by 50 cents. There will be no increase to tax on alcoholic beer or wine, either on-sales or off-licences.

Zoned Land Tax

The Finance Bill 2022 will include a number of amendments to streamline the operation of the Residential Zoned Land Tax to ensure its efficient administration.

Carbon Tax

Carbon tax to be raised from €41 per tonne to €48.50 in 2023. This equates to 2 cent per litre on motor diesel. However, there will be a reduction to the National Oil Reserves Agency (NORA) levy. The NORA levy which is collected at a rate of 2 cent per litre will offset the carbon tax increase which means that the price at the pump will not go up as a result of the carbon tax.

The Help To Buy Scheme

This scheme has been retained at its current rates to the end of 2024. This provides for a refund of Income Tax and DIRT of up to €30,000 on the purchase of a new house for first time buyers.

Windfall Energy Tax

The government will bring forward its own measures if Ireland cannot be part of the EU wide response to high energy prices.

No Changes To:

- Gift or Inheritance tax rates or group threshold bands

- CGT rates

Finally, the national reserve fund Budget will increase by €2 billion in 2022 and €4 billion in 2023.

The detail in the Budget and other amendments to tax legislation will be contained in the Finance Bill 2022 which is due to be published on 20 October 2022. However, please note some legislation will be passed tonight by Financial Resolutions.

This summary is intended as a general guide. No action should be taken without obtaining professional taxation advice.

If you have any queries, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700 or email your usual PMQ contact.

Purcell McQuillan Tax Partners Limited 27 September 2022

Copyright © *2022 Purcell McQuillan Tax Partners Limited, All rights reserved.