Notice to Property Owners: LPT Submission Deadline Approaching 7 November 2025

In summary:

- Determine the market value of each of your properties at 1 November 2025

- Submit the valuation of each of your properties in your LPT return by 7 November 2025

- Make arrangement to pay your LPT liability for 2026 from one of the options available

What is Local Property Tax (“LPT”)?

LPT is a tax which is payable on the market value of residential property situated in the State. For the purpose of LPT “residential property” means a dwelling house plus grounds and gardens with the land up to a total of one acre. Any sheds, garages or other buildings located on the grounds of up to one acre are also included in the valuation. Work carried out on the property since the previous valuation should be considered.

How is LPT calculated?

Valuation Date

The date on which the value of a property is taken for LPT purposes is 1 November 2025 for the tax year 2026. This value will also be used for calculating LPT due for 2027, 2028, 2029 and 2030 (The previous valuation date was 1 November 2021 for the years 2022 to 2025).

Rate of Tax

Where the market value of the property exceeds €2.1 million

You must declare a specific market value. For certainty, a professional valuation may be obtained. The LPT payable is calculated as the sum of:

- 0.0906% of the first €1.26 million of the declared market value of the property

- 0.25% of the portion of the declared market value between €1.26 million and €2.1 million; and

- 0.3% of the portion of the declared market value above €2.1 million

For example, if a property is valued at €3.5 million the LPT payable will be €7,441 (€1.26 million at 0.0906% + €840,000 at 0.25% + 0.3% of the balance of €1.4 million), ignoring Local Adjustment Factor mentioned below.

Where the market value of the property is €2.1m or less

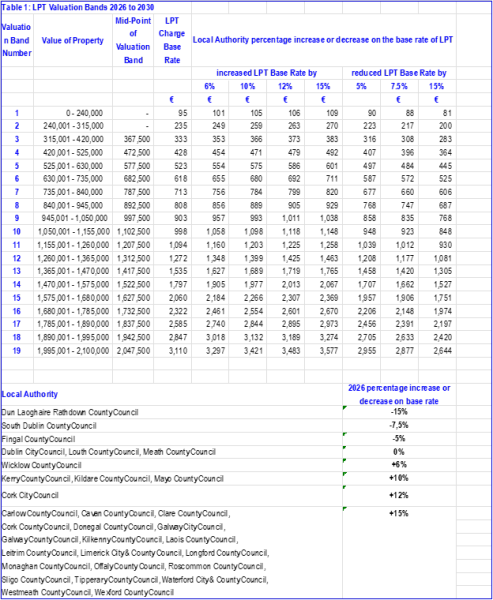

The LPT charge is selected from the appropriate valuation in the table below:

For example, if a property valuation is €1 million, the LPT charge base rate will be €903, ignoring Local Adjustment Factor mentioned below.

Each Local Authority has determined if an increase or decrease in the base rate of LPT should be applied (Local Adjustment Factor). This applies if the property is located within the Local Authority’s jurisdiction, regardless of the market valuation applied to each property. The LPT charge may vary across different properties and Local Authorities.

Who is liable to pay LPT?

Residential property owners are required to submit an LPT return to the Revenue Commissioners by 7 November 2025 and arrange for the annual payment of the LPT liability. Normally the owner of a property is the person liable to pay LPT. Where however a person has a life interest in a property, or an interest capable of exceeding 20 years, the person with the life interest is liable for the LPT payable in respect of the property. In the case of an estate the personal representatives are liable for any LPT payable in respect of residential properties contained in the estate.

Where a property is jointly owned each owner is liable for the LPT. Accordingly in such cases the joint owners should agree between them who will take responsibility for filing LPT returns and for paying the tax due.

Where a property is sold during the year the person liable to pay the LPT in respect of the property is the person who was the owner/held the life interest on the valuation date i.e. on 1 November 2025 and for 2026 and subsequent years on 1 November in the previous year.

If you receive a return for a property and do not consider that you are liable for LPT in respect of that property you should inform Revenue of this fact within 30 days otherwise you may be held liable for the LPT due in respect of that property.

Payment of LPT and filing of LPT return

When filing the LPT return by 7 November, the preferred payment option must also be selected. Where you are liable for LPT on more than one property, the payment of LPT must be made online.

The following payment options are available for 2026:

- Annual Debit Instruction for payment on 20 March 2026

- Monthly direct debit payments starting on 15 January 2026

- Phased payments for either deduction at source (through payroll) or regular cash payments (through a Payment Service Provider e.g. An Post) starting in January 2026

- Full payment through an approved Payment Service Provider or by debit or credit card by 9 January 2026

Penalties for Non-payment/Underpayment of LPT and for Not Filing LPT Return

If a person fails to make an LPT return or makes a false statement in a return they can be charged a penalty equal to the amount of the LPT payable up to a maximum of €3,000.

In addition if a person who is required to file returns under the Self-Assessment System for income tax and corporation tax does not file an LPT return on or before the due date for filing income tax/corporation tax returns, a surcharge of up to 10% of the income tax/corporation tax liability (subject to a maximum surcharge of €63,485) may be charged. If the person subsequently files, the outstanding LPT return the surcharge is reduced to the amount of the LPT liability if that is lower.

If LPT is not paid Revenue will pursue payment of the amount of their estimate of the LPT due. Interest at 0.0219% per day (8% per annum) is charged on the late payment of LPT.

Are there any exemptions to LPT?

The following residential properties maybe exempt from LPT:

- Properties unoccupied for an extended period (12 months or more) due to mental or physical infirmity or illness of the owner or if less than 12 months you are unlikely to return to the property.

- Properties acquired, adapted or built for use by permanently and totally incapacitated persons. In relation to the adaptation of the property, the cost of adaptation must amount to at least 25% of the value of the house before adaptation.

- Properties constructed using defective concrete blocks that are eligible for the Defective Concrete Blocks Grant Scheme.

- Properties occupied as a dwelling, but which are fully liable to commercial rates.

- Properties owned by charities and used by them for recreational activities in connection with their charitable activities.

- Properties owned by charities or other public bodies and used for the provision of special needs accommodation.

- Registered nursing homes.

This summary is intended as a general guide and has been prepared based on existing Revenue guidance and tax legislation. No action should be taken without obtaining professional taxation advice. If you need any assistance in ensuring that you are complying with your LPT obligations, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 668 2700 or email your usual PMQ contact.

Copyright © *2025 Purcell McQuillan Tax Partners Limited, All rights reserved