Retirement Relief

Transfers of Family Businesses to the Next Generation

Background

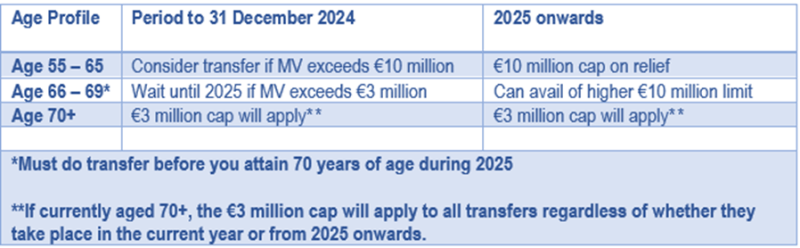

Retirement Relief could eliminate your capital gains tax liability when transferring your family business/ farm or shares in your family company (family business) to your children. Full relief is currently available on transfers subject to certain conditions if you are aged between 55 – 65. The relief is capped at €3 million on the market value of qualifying assets transferred if you are aged 66 or over.

From 1 January 2025 retirement relief will be capped at €10 million on the market value of qualifying assets transferred if you are aged between 55 – 69. The relief remains capped at €3 million if you are aged 70 or over.

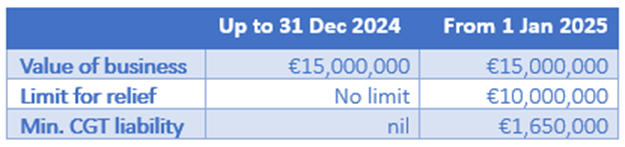

If the market value of your family business is in excess of €10 million you should consider transferring it prior to 31 December this year to maximise your retirement relief claim. The example below demonstrates the additional cost if the transfer occurs after 31 December 2024.

In order to avail of the relief, certain conditions will need to be satisfied. There will also be gift tax and stamp duty considerations in respect of which professional advice should be sought prior to any transfer. We would be delighted to advise if you are considering passing the family business to the next generation.

Summary Recommendations

This summary is intended to be a general guide. No action should be taken without obtaining professional taxation advice. If you require any advice on the above, please do not hesitate to contact Purcell McQuillan Tax Partners Ltd on 01 6682700, Eugene McQuillan eugene@pmqtax.com or Maria Doherty maria@pmqtax.com.